As CIB marks its 50th anniversary, what milestones stand out in the bank’s journey?

CIB’s 50 year journey mirrors the transformation of Egypt’s banking industry. We have grown from a single-purpose corporate lender to the nation’s largest private sector financial institution and a regional benchmark for performance, innovation and governance.

Along the way, we have been a first mover in shaping the market:

The first Egyptian bank to implement Basel capital standards (2012)

The first to launch a Security Operations Centre

The first to issue a green bond

The only Arab and African company included in the Bloomberg Gender Equality Index

The first major private sector bank to expand into sub-Saharan Africa, via our acquisition of CIB Kenya in 2023

Our story has been the subject of case studies at Harvard and London Business School. Most importantly, we have paired financial performance with social impact, through the CIB Foundation, which has reached over 7.4 million children since 2010.

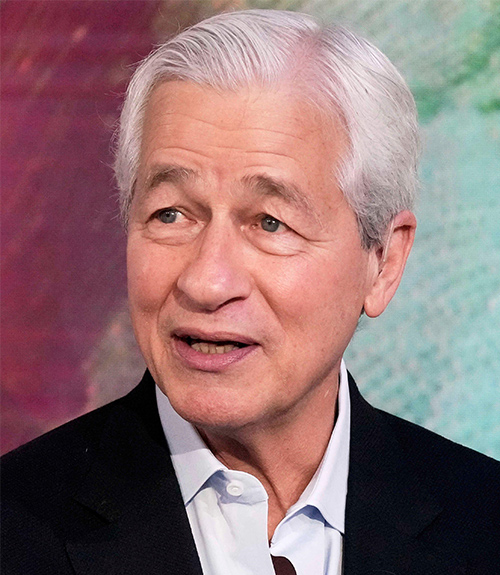

Jamie Dimon, chairman and CEO of JPMorgan Chase, whose predecessor Chase Manhattan Bank was an original shareholder in CIB from 1975 to 1987, sent a message of congratulation for CIB’s anniversary.

“Today [CIB] has grown to become the country’s largest private sector bank,” Dimon said. “That achievement and your continued success are a testament to innovation, ambition and visionary leadership.”

Addressing CIB’s CEO, Hisham Ezz Al-Arab, Dimon said: “I applaud all the work you’ve done to transform Egypt’s banking sector and to create an entrepreneurial culture that continues to drive growth in Egypt and across Africa. We are really proud that you are JP Morgan alumni.

“We share that drive and spirit at JP Morgan, along with the common values of integrity and a commitment to excellence.”

How has CIB’s role in Egypt’s financial system evolved over the decades, and what has remained constant in its mission and values?

Since separating from Chase Manhattan in 1987, we have grown from a niche corporate bank into a fully integrated financial institution serving Egypt’s largest companies, a rapidly expanding consumer base and the country’s growing SME sector.

What has remained constant is our foundation:

Disciplined governance and adherence to global standards

A long-term view on value creation for customers, communities and shareholders

A belief in financial services as an engine of national prosperity

What does this anniversary mean to your employees and stakeholders?

This milestone celebrates the people who built CIB, from a small team of visionaries to a workforce of over 8,000 professionals powering one of the most respected financial institutions in the region. For our employees, it reaffirms the culture that makes CIB unique — a place where merit drives progress, innovation is rewarded and every colleague plays a part in shaping Egypt’s financial future.

For our investors, it reinforces that CIB is a long-term value creator. Over the past two decades, we have delivered sustained outperformance across all metrics, including a twentyfold increase in market capitalisation since 2002.

How has CIB maintained resilience through periods of change?

Our strength lies in a model that blends conservative financial management with bold strategic execution. We have weathered multiple external shocks — from global financial crises to currency devaluations — by staying true to our principles. These include prudent risk management, healthy capital buffers and liquidity positions, and forward-looking asset allocation.

Our success is also defined by agility. We have consistently adapted our operating model to seize emerging opportunities.

Looking ahead, how does CIB plan to serve future generations of clients and communities?

Egypt is on the verge of a generational shift. With more than 60% of its adult population still unbanked and mobile adoption among the highest in the region, the opportunity for financial inclusion powered by digital transformation is immense.

We see this not just as a market gap but as a national imperative.