Just how much monetary policy juice do EM central banks have? Is it back to 2008-2009, when economic activity slumped and prices tumbled, prompting central banks across EM to slash rates aggressively in a bid to kickstart growth.

On the basis of last week’s monetary policy decisions, the doves see to be winning, citing the ongoing eurozone crisis. To wit, Brazil cut by -50bps to 10.50%, Georgia -25bps to 6.50%, Philippines -25bps to 4.25%, Serbia -25bps to 9.50% while Indonesia reduced the overnight deposit rate by 50bp. That flurry of activity left only South Africa and Mexico to sit on the fence.

In fact, the prospect of monetary easing in EM could help account for the surprising 9% rally in the MSCI Emerging Markets Index year-to-date, with EM equity funds recording a second consecutive week of $1 billion-plus inflows last week, according to fund flow tracker EPFR. By contrast, in 2011, the converse happened: the interest rate and inflation cycle proved sharper than expected, dragging down EM equities.

According to EPFR’s global director of research, Cameron Brandt:

| Investors are starting to pencil in a lot of quantitative easing, interest rate cuts and fiscal stimulus to their assessment of the global economy’s prospects, with all that means for growth, yields and inflation. |

Adds HSBC’s head of Emerging Market strategy Pablo Goldberg and team:

| The outlook for growth and inflation has changed quickly for EMs. Global investors take note: In contrast to European policy sluggishness, EM policy makers have a lot of potential firepower to reflate their economies. |

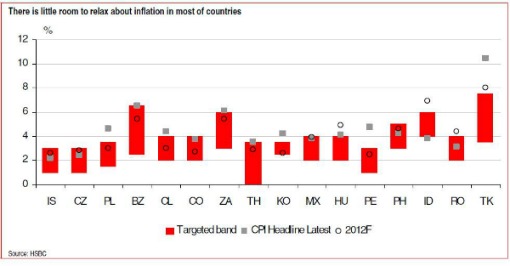

Yet at the same time, many EM central bank governors remain conscious of the fact that the inflation threat may not have been completely tamed, especially given widespread currency weakness across emerging market regions in recent months. While headline consumer inflation has moderated across EM in recent months, even in countries with stubbornly high inflation rates such as India, CPI continues to track above, or at the top end of, central bank targets.

This chart from HSBC’s Emerging Markets research team illustrates this point nicely:

|

HSBC economists expect yearly EM inflation to decrease to 5.6% in 2012 from 6.4% in 2011 led by rapid disinflation in Asia ex-Japan, to 4.5% from 6%, followed by Latin America, to 7.4% from 7.9%. Meanwhile, EMEA inflation is forecast to remain “stable but elevated” at 6.3%, “balancing slower growth and lower commodity prices with FX pass-through”. Here’s how HSBC economists sum up the monetary policy challenge:

| The inflationary impact from weaker currencies is a challenge for many countries at the moment. However, we are of the view that depending on the degree of the commodity correction and growth downturn and their effects on local prices, the FX pass-through effect on inflation will vary. In other words, in an environment similar to that in 2008- 2009, when economic activity and international food prices decelerate rapidly, inflationary pressures stemming from FX volatility will be limited, we expect. However, if the downturn in growth and commodity prices turns out to be relatively mild, the FX pass-through effect will likely be more concerning. Therefore, we anticipate that the pace of rate cuts is likely to continue to be moderate, as there is little room to relax completely about inflation. |

So, in sum, expect moderate easing across the EM world, but FX volatility is definitely something to watch out for, and for the doves, so is growth. Net-net: cuts, but don’t expect anything too aggressive. Unless the eurozone crisis explodes, triggering off another major financial crisis, and EM growth rates fall off a cliff, that is.

| EM policy makers have switched the reflating mode back to “on,” and we expect them to accelerate their efforts if conditions warrant a more-aggressive response. |

A final thought to leave you with, though. As policymakers across the EM space have shown over the past two years, interest rates are by no means necessarily the preferred tool of choice any more, especially given concerns over currency valuations and capital flows. So-called “unorthodox” monetary policy moves, such as tweaking banks’ reserve requirement ratios, or introducing capital controls, are now very much part of the mainstream policy toolkit and this is likely to remain the case.

Those looking to interest rate movements as the barometer of monetary policy intentions will only be seeing part of the picture.

Still, investors should take solace in the fact that it’s difficult to imagine the monetary policy transmission in any emerging market economy to be as broken as the eurozone right now.