Construction has always been central to Qatar’s economic strategy. From cutting edge liquefied natural gas architecture and world class sports stadiums to high tech metros and airports, infrastructure has defined the city state’s early growth model.

Under Qatar National Vision 2030, the emphasis is shifting: infrastructure is no longer only about hydrocarbons and prestige projects, but about supporting diversification, digital connectivity and sustainability.

Sovereign entities still drive most large scale projects, but banks are starting to take on a more visible role. By participating in project finance, co-financing packages and targeted lending, Qatari institutions are extending the reach of national plans.

Beyond traditional real estate lending, they are now financing projects that tie directly into national diversification goals. One example is Doha Bank’s role in a QR2bn ($550m) syndicated package for Ooredoo’s data centre expansion. A perfect example of how infrastructure overlaps with digitalisation and economic competitiveness.

National champions and mega-projects

Infrastructure financing also underpins Qatar’s global ‘national champions’. Companies such as Qatar Airways, Ooredoo and Qatar Energy depend on large scale financing to expand both domestically and abroad.

This backing not only sustains critical industries but also strengthens Qatar’s role as a hub for trade, transport and energy. Banks like QNB have been at the forefront of this financing effort, contributing to aviation, telecoms and the energy supply chain, as well as core physical and social infrastructure, from highways to hospitals.

Banking View

BUILDING AN INTERNATIONAL HUB

How is the bank contributing to Qatar’s long term infrastructure development?

QNB Group plays a pivotal role in driving Qatar’s development by supporting national strategic projects.

From financing the LNG supply chain that established the country as the world’s largest exporter of natural gas, to supporting the growth of national champions like Qatar Energy, our role has been foundational. Recent examples include:

- Leading a QR4.5bn ($1.2bn) strategic financing for Qatar Airways in 2025 to strengthen national connectivity

- Partnering with Ooredoo in 2024 on a $1bn programme to expand digital capacity

We also continue to finance core social and physical infrastructure, including roads, railways, ports, utilities, healthcare and education. This integrated approach ensures a sustainable development aligned with the human, social and economic pillars of the Qatar National Vision 2030.

How is QNB balancing its role in financing national champions with the need to fund emerging non-hydrocarbon sectors and green infrastructure?

Our financing footprint spans critical sectors. Examples include:

- Energy — We continue to support the North Field Expansion (NFE), which will increase LNG capacity by 85% to 142m tonnes per year by 2030. Our financing covers the complete value chain.

- Food Security — We financed projects enhancing self-sufficiency, innovative farming and storage, contributing to Qatar’s rise in the Global Food Security Index.

- Hospitality — We supported Qatar’s tourism drive through financings such as the $5.5bn Simaisma resort, reinforcing Qatar as a global destination.

- Infrastructure — We participated in large projects including a $19.2bn government capex package and major works in highway maintenance and metro expansion.

Collaborative co-financing

Despite rising bank participation, Qatar’s infrastructure agenda remains heavily state-driven. MR Raghu, CEO of Marmore MENA Intelligence, notes that large projects are still largely financed by the Qatar Investment Authority, state-owned firms such as QatarEnergy, or direct budgetary spending.

Yet local banks are carving out bigger roles. QNB, Doha Bank and others are increasingly involved in syndications and mid-sized project finance deals.

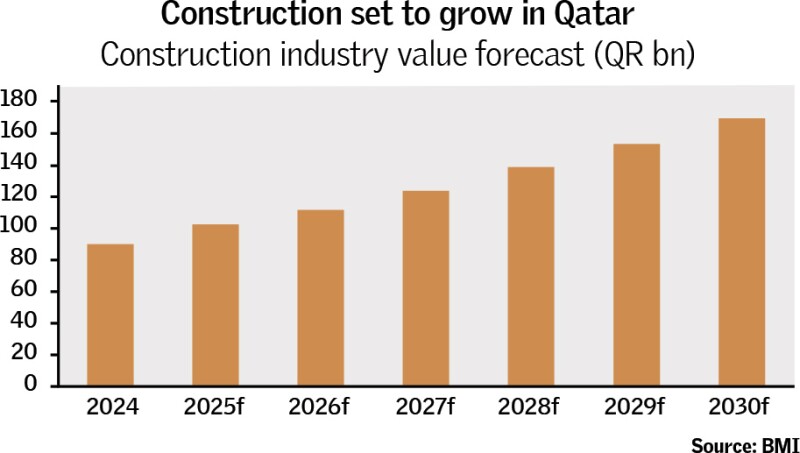

Analysts at BMI, the country risk and industry research firm, point to the Public Works Authority (Ashghal)’s ambitious new five year programme of works, worth around $22bn. Launched in May this year, it covers roads, housing, utilities and public services.

“This marks the largest infrastructure investment programme in Ashghal’s history by value and scope,” according to BMI’s latest Qatar Infrastructure Report. “Contract awards in the [infrastructure] sector are expected to increase sharply between 2024 and 2029, reflecting both population growth and the government’s energy transition targets.”

The research firm expects future projects to prioritise transport connectivity, healthcare and education facilities — all seen as enablers of private sector growth under Qatar National Vision 2030.

Foreign investors, meanwhile, remain concentrated in hydrocarbons. International oil majors such as Shell, TotalEnergies, ExxonMobil, Eni and ConocoPhillips hold equity stakes in multi-billion dollar LNG projects. But large scale solar projects are also ramping up as the country looks to diversify its energy mix.

BMI emphasises that outside the energy sector, foreign involvement in Qatar’s infrastructure has been more modest than in the UAE or Saudi Arabia, which have embraced wider PPP frameworks.

Its data suggest domestic financiers still account for just over half of all project funding across large scale infrastructure, leaving much scope for cross-border capital and foreign equity partners.

As Qatar looks ahead, co-financing models that bring together state funding, local banks and foreign capital will be key to delivering infrastructure that is smarter, greener and firmly aligned with Vision 2030’s goals of global competitiveness and sustainability.