The history of Qatar’s economic growth is inseparable from hydrocarbons. Natural gas deposits have propelled the country to the top of global energy markets and national per capita income rankings.

But the city state has also built a reputation for long-sighted strategy. Its government is pushing hard to transform Qatar into something more than simply a major energy exporter. Crucial to this transformation is building a more dynamic private sector to reduce reliance on state-led, hydrocarbon-fuelled investment.

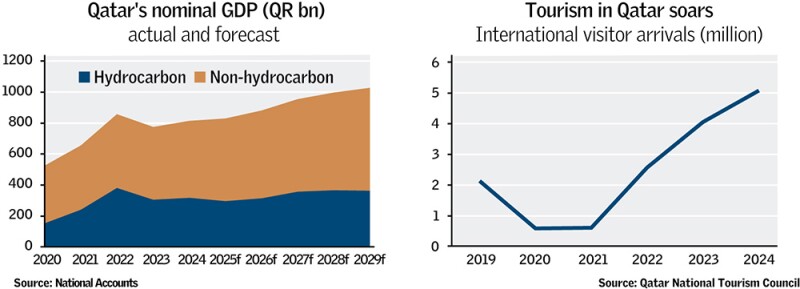

The effort has already begun to show results. The non-hydrocarbon sector accounted for 61% of GDP in 2024, up from 48% in 2010, according to the International Monetary Fund. Tourism, property and services are all major contributors to that growth. Over five million foreign visitors arrived in 2024 — a 25% rise on the year before.

“Major policy reforms under the Third National Development Strategy [known as ND3] and National Vision 2030, focusing on improving business conditions and fostering public-private partnerships, have contributed considerably to reducing Qatar’s reliance on the oil and gas sector,” says MR Raghu, CEO of Marmore MENA Intelligence, a research firm.

Marmore MENA Intelligence on reforms:

“Qatar’s non-hydrocarbon diversification is slightly behind that of GCC peers such as UAE and Saudi Arabia. Both have been more aggressive in their approach to private sector reforms that include lowering foreign ownership restrictions, updating regulations to make them more business-friendly, relaxing visa restrictions for expats, providing support to the SME sector, providing incentives for foreign companies to set up their regional headquarters and widening their capital markets.”

Launched in early 2024, the government’s ND3 is designed to support economic diversification and the transition to what the IMF calls a “more sustainable and knowledge-based economy”. The state may be the enabler of this transition, but behind the shift are banks and investors working together to create an ecosystem where private businesses can thrive.

Qatari bank lending to the private sector has soared, from less than QR200bn ($55bn) a decade ago to over QR900bn ($247bn) as of July 2025, according to QNB Financial Services data.

Local banks are positioning themselves as partners for small and medium-sized enterprises, entrepreneurs and major corporates. Venture capital investors argue there has never been a better moment for start-ups to take root in Doha.

Banking View

CONTINUITY AND TRANSFORMATION

What role does QNB play in connecting Qatari companies with international capital, expertise and markets?

QNB plays a key role in bridging Qatar’s established strengths with its future ambitions.

We remain the trusted partner for energy, infrastructure and trade, while increasingly financing and enabling emerging sectors such as digital infrastructure, fintech, logistics and green industries.

We are also at the forefront of innovation. We became a long term strategic partner of Qatar’s first Web Summit, which gathered more than 15,000 global entrepreneurs, founders and investors. During the Summit, QNB signed memorandums of understanding with QDB and the Qatar Financial Centre, and we have onboarded around 10 local fintech companies into our business model, further strengthening our role in fintech and embedded finance.

At the same time, we embed sustainability across financing. From clean transport and renewable energy to affordable basic infrastructure and sustainable food systems, we ensure traditional industries generate pathways for green and social progress through our Sustainable Finance and Product Framework.

Coupled with spillover opportunities from the North Field Expansion, this dual approach sustains legacy strengths, while accelerating diversification. In this way, QNB delivers both continuity and transformation, safeguarding the foundations that built Qatar, while catalysing its diversification into inclusive, knowledge-driven and future-ready industries, in line with Qatar National Vision 2030.

Energising entrepreneurs

Qatar’s diversification drive is in part about redirecting capital from the state-owned to the private sector. But it is also about creating the partnerships and support structures that will transform the country’s entrepreneurial businesses into engines of growth.

In this sense, the country’s banks are emerging as critical architects of a broader ecosystem. By aligning with state priorities under Vision 2030, they are helping to channel funds into sectors such as healthcare, tourism and technology — industries expected to form the backbone of the new, more resilient economy.

Leading lenders are collaborating with national agencies such as the Qatar Development Bank and the Qatar Financial Centre to better support non-hydrocarbon industries. It is these partnerships that allow banks to back SMEs and mid-sized firms with a mix of financing, advisory services and export support.

At the same time, they are embedding sustainability and green finance into their strategies, ensuring that emerging businesses can grow in ways that align with Qatar’s long term goals.

Diversification is no longer a side project — it is hardwired into the city state’s financial sector strategy. The result is an institutional effort to provide clients with more than just credit lines. Qatari banks are helping the private sector digitalise, innovate and compete on the global stage.

Banking View

FLEXIBLE FINANCING FOR SMES

What role is the bank playing in supporting SMEs and expanding financial inclusion across Qatar?

Doha Bank recognises the important role that small and medium-sized enterprises and entrepreneurs play in fostering innovation and generating employment.

To support their growth, the bank offers a comprehensive suite of financing and transaction banking services. These include flexible credit solutions, such as working capital and asset-based lending, tailored to meet the operational needs of SMEs, including invoice financing and equipment loans.

Through partnerships like Qatar Development Bank’s Al Dhameen programme, the bank also provides credit guarantee schemes that offer guaranteed loans, reducing risk for both the bank and the borrower, while enhancing access to finance.

In addition, Doha Bank has streamlined SME services through digital platforms, offering mobile banking, payroll solutions and real time account management tools. These initiatives are designed to help SMEs navigate evolving economic conditions and build resilience in an increasingly competitive market environment.

Financing SME innovators

Grand national strategies grab headlines, but for many smaller businesses, survival and growth hinges on affordable working capital, smoothing cash flows and digitising their services.

That is why Qatar’s banks are sharpening their focus on SMEs as a policy and financial priority. SMEs account for a growing share of non-hydrocarbon activity. They are vital to job creation, innovation and resilience. For the financial sector, supporting these firms means going beyond conventional corporate lending and creating products that address specific pain points.

Liquidity support tools such as receivables financing, invoice discounting and credit guarantees are becoming more widespread. Banks are also embracing digital-first service delivery — end-to-end onboarding, e-KYC and dedicated SME platforms are now standard.

At the same time, sustainability is increasingly part of the equation: green loans for solar installations or electric vehicles show how banks are aligning small business finance with environmental priorities.

Partnerships with accelerators and government-backed programmes extend the reach of these efforts, ensuring SMEs are not just borrowers but participants in a wider ecosystem of innovation. Advisory services, networking opportunities, and technical assistance now sit alongside lending, reflecting a new model in which banks position themselves as long term partners for SME resilience.

Banking View

BROADENING BANKING

What role is QIB playing in supporting SMEs and expanding financial inclusion across Qatar?

Financial inclusion is a core pillar of QIB’s strategy to build a more equitable and digitally empowered economy. The bank provides access to Shari’a-compliant financial services that support the needs of all customers in Qatar, across all segments. This commitment is embedded across QIB’s operations, product design and digital innovation roadmap.

For SMEs, which are vital to Qatar’s private sector diversification, QIB provides tailored finance solutions, streamlined onboarding and digital tools such as SoftPOS, Corporate Internet Banking, the Corporate Mobile App and the Corporate Credit Card.

These services simplify access to finance, strengthen expense management and improve operational efficiency, helping SMEs scale sustainably.

QIB’s financial inclusion strategy also extends to underserved and emerging audiences. The launch of our QIB Lite App, available in eight languages, supports low income earners and domestic workers with simplified banking and international transfer capabilities.

The QIB Junior programme introduces children to financial literacy in a secure, engaging environment, while Bedaya, the university student account, helps young adults begin their banking journey with tailored benefits and easy digital onboarding.

Risks and resilience

Any open, trading economy is vulnerable to external shocks, and Qatar is no exception. As with its neighbours in the Gulf Cooperation Council, swings in hydrocarbon prices filter quickly through to national income, government budgets, the private sector and household spending.

Oxford Economics’ associate director Azad Zangana says his firm’s analysis shows that in the event of a 10% fall in the price of oil and gas, Qatar would feel the second largest hit to consumer spending across the GCC.

But the country fares somewhat better on private investment, facing only the fourth highest impact — a 1.5% decline.

Beyond volatility in energy markets, structural factors could also weigh on the private sector’s ability to expand. As the IMF has cautioned, banks’ large holdings of public sector assets — around 30% of total assets — could crowd out credit to the private sector and slow the transition to private sector-led growth.

Much needed reforms could help make private sector momentum more unstoppable.

Capital Economics points to the business environment as an area where progress is still needed. “Across the Gulf — outside the UAE, particularly Dubai — there’s work to be done on transparency and making markets more attractive to foreign investors,” says James Swanston, senior emerging markets economist at Capital Economics. “Investors want assurance that if they put money in, they can take it out without lengthy court battles.”

Capital Economics on diversification:

“Compared to Saudi Arabia or the UAE, where diversification is about getting away from oil, Qatar sees liquefied natural gas as a transition fuel. It’s setting itself up as a global leader in LNG for decades to come. There’s been strong interest from Europe and Asia to secure access to the North Field. Once that’s online, it will create the fiscal space to further support non-hydrocarbon and private sector growth.”

Saudi Arabia has already begun reforming its judicial system, offering proceedings in English and drawing on Western legal practices to reassure international investors. While Qatar has not yet moved as far, adopting similar measures could help it attract more foreign direct investment and strengthen its private sector base.

PwC highlights another route to resilience: expanding the role of public-private partnerships. By drawing on private capital and expertise for infrastructure projects, the government can share financial risk, while tailoring investments to business needs.

Automated cargo handling systems at ports and next generation warehouses are examples of how PPPs can align infrastructure with private sector priorities, creating efficiency gains and encouraging innovation.

At the same time, building a competitive ecosystem is seen as essential for sustaining long term diversification. Entities such as the Qatar Financial Centre and Qatar Free Zone Authority already act as gateways for investors, offering incentives, regulatory guidance and support frameworks.

PwC suggests that further reforms — easing business set-up, expanding tax incentives, strengthening bilateral trade agreements and improving financial protections — could substantially increase Qatar’s appeal to international capital.

Banking View

SUPPORTING SMALL BUSINESSES

What types of financing or advisory support is the bank offering to help entrepreneurs and SMEs adapt to evolving economic conditions?

Our commitment goes beyond banking — we provide integrated solutions covering working capital, savings, liquidity and tailored products.

QNB enables SMEs and entrepreneurs to effectively adapt to evolving economic conditions through its comprehensive suite of products and services, complemented by strategic initiatives such as partnerships and development programmes. Examples include:

- Liquidity products such as receivables financing and medical claims discounting, improving cash flow

- Innovation platforms and tech ecosystem: In September 2025, QNB partnered with the Ministry of Communications and Information Technology to support the TASMU Accelerator initiative, focusing on healthcare, transport, logistics, environment, financial services and smart cities

- SME enablement and sponsorships: We offer dedicated SME accounts and credit facilities, and we regularly sponsor entrepreneurship platforms such as Rowad and the Arab Entrepreneurship Conference with QDB. These provide day-to-day banking, working capital, trade and merchant acquiring rails for SMEs

- Specialised advisory offered through SME Branches, as well as other services beyond banking, including market insights and networking opportunities, to build resilience and competitiveness

- SME digitisation, with over 90% of services now digital, including end-to-end onboarding, e-KYC and QNB Simplify for e-commerce

- Sustainability in SME banking, including green vehicle loans, mortgages, solar energy and more

Entrepreneurship and start-ups

If banks are the anchors of diversification, venture capital is its engine. For entrepreneurs in Qatar, momentum is building, thanks to new investment programmes and the visibility generated by the Qatar Investment Authority Fund of Funds initiative.

Investors argue that entrepreneurship should not be seen as just another sector under Vision 2030. Instead, it is best seen as an enabler for several of the Vision’s pillars, from economic to social development. This broader role has helped create space for start-ups to emerge in areas that cut across industries.

“There has never been a better time to start a company in Qatar,” says Alexander Wiedmer, founder and partner at Rasmal Ventures. “Investment programmes developed over the last two years are attracting fund managers and entrepreneurs — the ecosystem is becoming wider and more international.”

Wiedmer describes GCC venture capital as “generalist and opportunist” — necessary in a relatively young market that lacks the depth of the US or Europe.

That means backing a mix of business-to-business and business-to-consumer companies across sectors, while paying particular attention to strategic areas such as logistics, fintech, digital health and agritech. AI and deeptech are beginning to surface, but remain less prevalent than in other regions.

Qatar still has fairly few VCs on the ground, compared with neighbours such as the UAE and Saudi Arabia. That is slowly changing thanks to initiatives like the QIA Fund of Funds, in which the state’s $560bn sovereign wealth fund QIA is investing in a select group of international venture capital fund managers, specialising in priority sectors, including Deerfield and B Capital.

When start-ups do secure equity backers, traditional bank financing is often off limits without personal guarantees from founders. This makes borrowing money very difficult for founders, who then have to self-finance or find equity backers.

“There are starting to be non-dilutive funding vehicles for start-ups in the region and this will likely only grow, but they are typically for later stage start-ups,” says Wiedmer. “Thankfully there is some help from the Qatar Development Bank, which has products designed to support SMEs, and the Development Bank does work closely with VCs.”

Landmark exits are beginning to shift perceptions. The sale of 77% of local shopping delivery platform Snoonu to Saudi Arabia’s Jahez Group for $245m in July marked Qatar’s first major venture-backed exit. Wiedmer suggests this will encourage more investors to take Qatari startups seriously.

Still, structural challenges persist, such as slow payments by large corporates and government clients. In other markets, policymakers have introduced quick payment obligations for contracts with start-ups. Similar reforms in Qatar could make a tangible difference.

Ultimately, attracting more international capital and cross-border investment will be critical for Qatar’s start-up and SME landscape.

“No innovation ecosystem can exist in a silo,” says Wiedmer. “Young Qatari companies have to be able to attract outside investors to be taken seriously. This is why the QIA Fund of Funds programme is so important: it puts Qatar on the map.”